Money

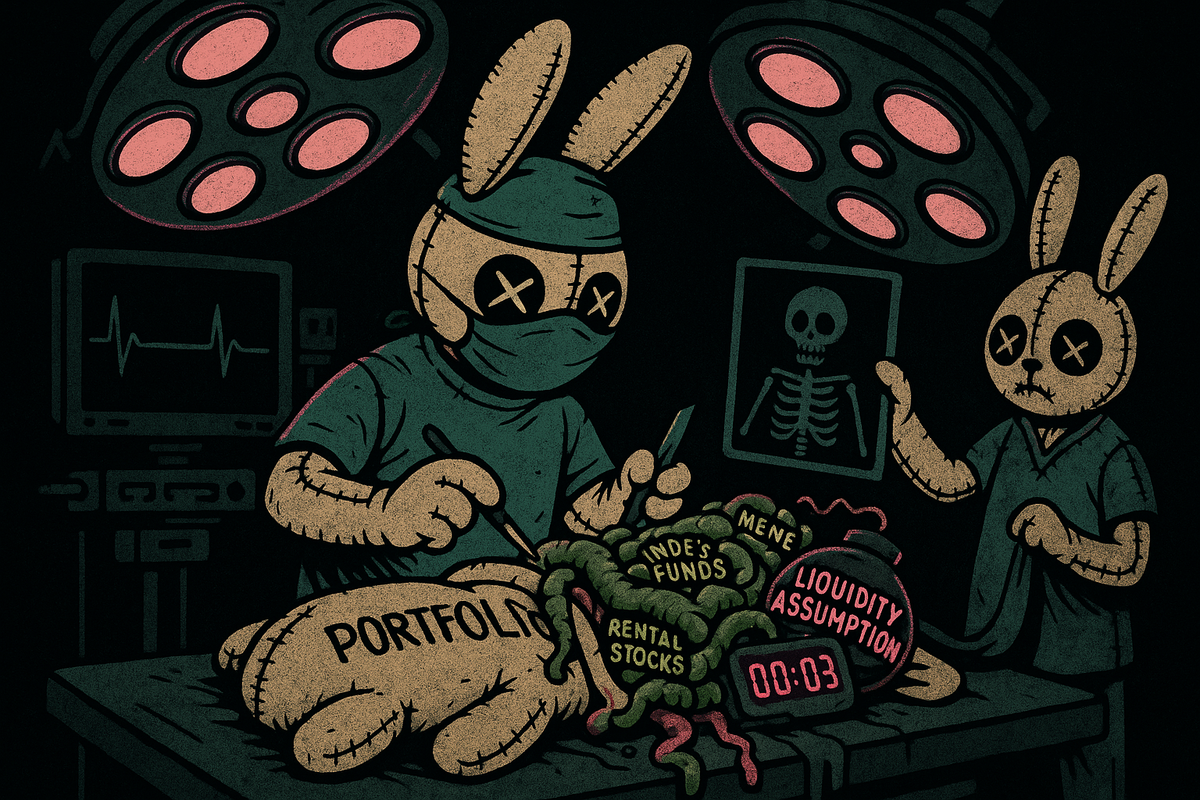

The geometry of not going broke.

Markets are complex adaptive systems. Your retirement account doesn't care about your feelings. And most financial advice is calibrated for a world that doesn't exist anymore.

Here's what the frontier research actually says—without the guru energy or the get-rich promises.