Barbell Geometry: The Shape That Survives

The middle doesn't give you upside of risk or safety of safety. Learn why barbell geometry—extreme safety + convex bets—survives fat-tailed outcomes better than balanced portfolios.

Why extreme safety plus extreme risk beats medium risk every time

Pillar: MONEY | Type: Pattern Explainer | Read time: 9 min

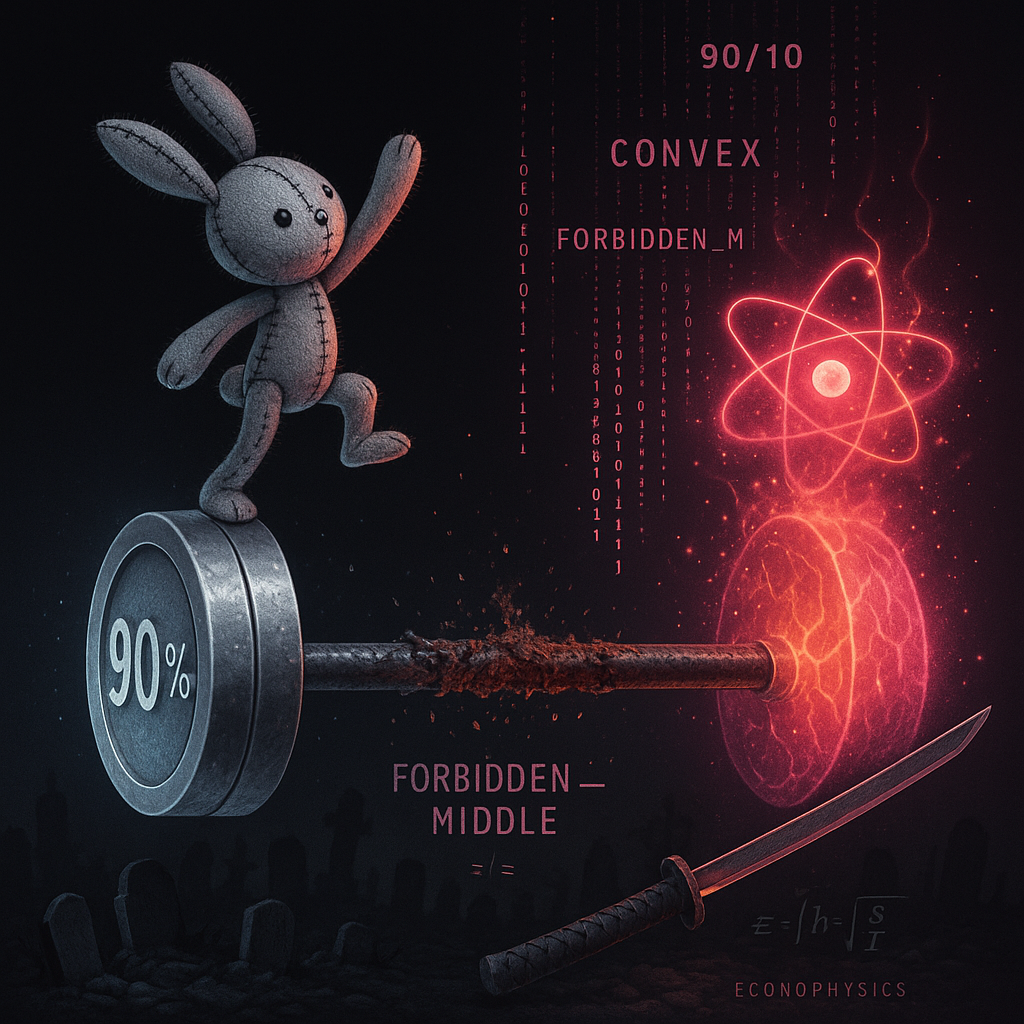

The Forbidden Middle

The balanced portfolio. 60/40 stocks and bonds. Medium risk, medium return. Sounds reasonable. Feels responsible. Financial advisors love it.

It's a trap. The middle doesn't give you the upside of risk or the safety of safety. It exposes you to ruin without compensating upside. In a fat-tailed world, the middle is where you slowly bleed in calm markets and die in tail events.

The barbell rejects the middle. Extreme safety on one end (T-bills, cash, things that survive anything). Convex exposure on the other end (small bets with limited downside and unlimited upside). Nothing in between. Not because the middle is wrong in theory, but because the middle doesn't survive the actual distribution of outcomes.

The Pattern: Antifragility Through Asymmetry

Taleb's core insight: some things benefit from volatility, uncertainty, and stress. They're not just robust (unchanged by stress) but antifragile (improved by stress). The barbell is how you construct antifragility.

The safe side protects against ruin. It's the floor you can't fall through. No matter what happens, you survive. This isn't about returns—it's about existence. You can't compound from zero.

The convex side captures upside. Small positions, limited loss, unlimited gain. You're buying options—not literally, but structurally. Each bet can lose 1x but win 10x or 100x. You need most of them to fail; you only need a few to succeed enormously.

Together they create positive asymmetry. Downside is bounded (the safe side catches you). Upside is unbounded (the convex side compounds wins). The portfolio as a whole benefits from the volatility that destroys the middle.

The Mechanism: Why the Middle Fails

Convexity and Concavity

Positions have shapes. A convex position gains more from favorable moves than it loses from unfavorable ones. A concave position does the opposite—losses outweigh gains.

Medium-risk positions are typically concave. Leveraged ETFs, yield-chasing strategies, carry trades—they make small gains most of the time and occasional catastrophic losses. They're selling optionality. They're short gamma. They're picking up pennies in front of steamrollers.

The barbell is net convex. The safe side has no gamma (linear, flat payoff). The risky side is long gamma (convex, accelerating payoff). The combination benefits from volatility rather than being destroyed by it.

Path Dependency and Ruin

The order of returns matters. A portfolio that loses 50% then gains 100% ends up at... breakeven (0.5 × 2.0 = 1.0). The arithmetic average return was +25%, but you made nothing. Sequence matters because wealth is multiplicative, not additive.

Medium-risk portfolios can't survive large losses. A 60% drawdown requires a 150% gain to recover. A 90% drawdown requires a 900% gain. Once you're deep in the hole, arithmetic means almost nothing. The path took you to a place from which there's no reasonable return.

The barbell's safe side prevents catastrophic drawdowns. You never need 900% returns to recover because you never lost 90% in the first place. The safe side isn't about returns—it's about staying on paths that can still compound.

Optionality Value

Options increase in value with volatility. The convex side of the barbell is effectively long volatility—the more chaos, the more opportunities for small bets to pay off enormously. This is the opposite of most investors, who are implicitly short volatility (their strategies work until the regime changes).

Cash is an option. It gives you the right to buy distressed assets when everyone else is being forced to sell. In calm markets, cash is a drag. In crisis, cash is the ultimate optionality. The barbell holds that optionality constantly, paying the small cost of missed returns for the enormous value of crisis deployment.

The Application: Building Your Barbell

Safe side: boring, boring, boring. T-bills. FDIC-insured deposits. Short-term sovereign debt (in your home currency). Nothing clever. Nothing yield-enhanced. Nothing that requires someone else to stay solvent. The point is survival, not returns.

Risky side: convex bets only. Small positions where you can lose 100% of the bet but gain multiples. Venture-style exposure. Deep out-of-the-money options. Asymmetric opportunities where the market is mispricing tail outcomes. Never risk more than you're willing to lose entirely.

Ratio depends on your situation. 90/10 (safe/risky) is conservative. 80/20 is more aggressive. The ratio determines how much you need the convex side to hit. With 90/10, you can survive most convex bets failing. With 80/20, you need higher hit rates. Choose based on your runway and risk tolerance.

Rebalance mechanically. When convex bets win, take profits and replenish the safe side. When they lose, don't replace them from the safe side unless it's restored. The barbell requires discipline to maintain. Drift toward the middle destroys the shape.

Beyond portfolio: barbell your life. Stable income (boring job, reliable revenue stream) + asymmetric upside projects (side ventures, speculative skills). Stable relationships + openness to serendipity. The barbell is a life architecture, not just an investment strategy.

The Through-Line

The middle is a trap. It feels balanced but it's actually fragile—exposed to ruin without compensating upside. In a fat-tailed world, the moderate position is the most dangerous.

The barbell survives because it has a floor that can't break and a ceiling that can't bound. The safe side keeps you alive. The convex side captures chaos. Together they transform volatility from enemy to ally.

Extreme safety + extreme risk beats medium risk. Not because extremes are inherently good, but because the geometry of fat tails demands asymmetry. The shape that survives isn't balanced. It's barbelled.

Substrate: Convexity Theory, Antifragility (Taleb), Optionality Pricing, Path Dependency